tax deductions for high income earners 2019

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. When you claim federal tax credits and deductions on your tax return you can change the amount of tax you owe.

The Hierarchy Of Tax Preferenced Savings Vehicles

The Tax Cuts and Jobs Act the tax reform legislation passed in December made major changes to the tax law including.

. Tax deductions lower the amount of income thats subject to taxation by the IRS. In both scenarios taxpayers earning above these thresholds dont qualify for the tax benefits. But for many high earners they are unable to fund Roth IRAs due to income limits.

Whether You File Your 2022 Tax Returns Online Or In-Office We Can Answer Your Questions. You can deduct up to 60 percent of your adjusted gross income each year for gifts of money. One of the best ways for high earners to make charitable contributions is to establish a donor-advised fund.

They help reduce your taxable income meaning youll pay less in taxes and preserve more of your earnings. The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. The age for Required Minimum Distributions RMDs from retirement accounts was raised to 72.

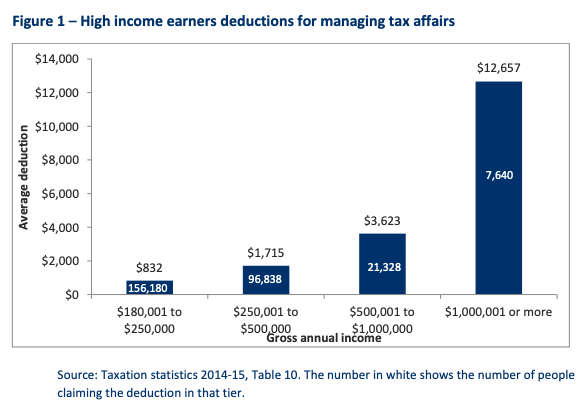

Ad Answer Simple Questions About Your Life And We Do The Rest. In some situations higher-income means adjusted gross income 186000 for IRA contributions or 315000 for the new business income deductions for partnerships. If youre self-employed you pay both the employer and employee portion and then deduct the employer portion on Form 1040.

Charitable giving can be one of the most attractive tax shelters for high income earners who want to do good while getting a tax break. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions that affect the high income earners retirement planning and tax planning strategies. 50 Best Ways to Reduce Taxes for High Income Earners.

Check with a tax professional to find out more. Standard deduction of 24000 Fourth Year. Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund.

High-income earners may pay an additional 235 Medicare tax. For 2018 you cannot fund a Roth IRA if your income. Itemized deduction of 60000 50000 charitable giving 10000 SALT Third Year.

The annual contribution limits are a little bit lower though 13000 in 2019 or add another 3000 if youre 50 and older so you have a 16000 annual contribution limit. The SECURE Act. Given that high-income taxpayers are likely to be stuck in an income tax bracket of 32 35 or 37 thats a.

From Simple To Complex Taxes Filing With TurboTax Is Easy. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax bill or penalty when they file their 2018 federal income tax return in 2019. In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them.

File With Confidence Today. This allows you to do the same annual contributions as. Itemized Deduction of 60000.

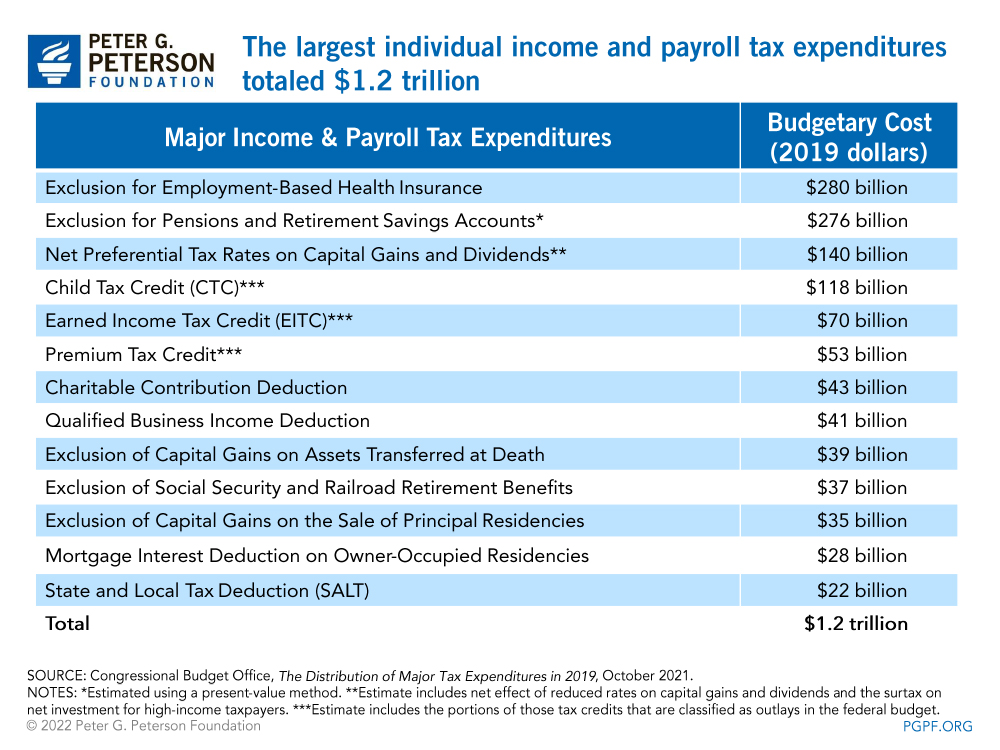

Meanwhile long-term capital gains tax rates are much lower and cannot exceed 20. Learn More at AARP. Under the TCJA the IRS allows you to deduct cash contributions to eligible charities with the deduction maxing out at 60 of adjusted gross income AGI.

For 2019 the employer and the worker each pay a 765 tax. A donor-advised fund is like a charitable investment account. Standard deduction of 24000 Second Year.

It would look like the following. You may take an itemized deduction for contributions of money or property to a tax-qualified charity. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Credits can reduce the amount of tax you owe or increase your tax refund and some credits may give you a refund even if you dont owe any tax. High-net-worth individuals that have self-employment income and its only you or you and your spouse can set up a Solo 401k.

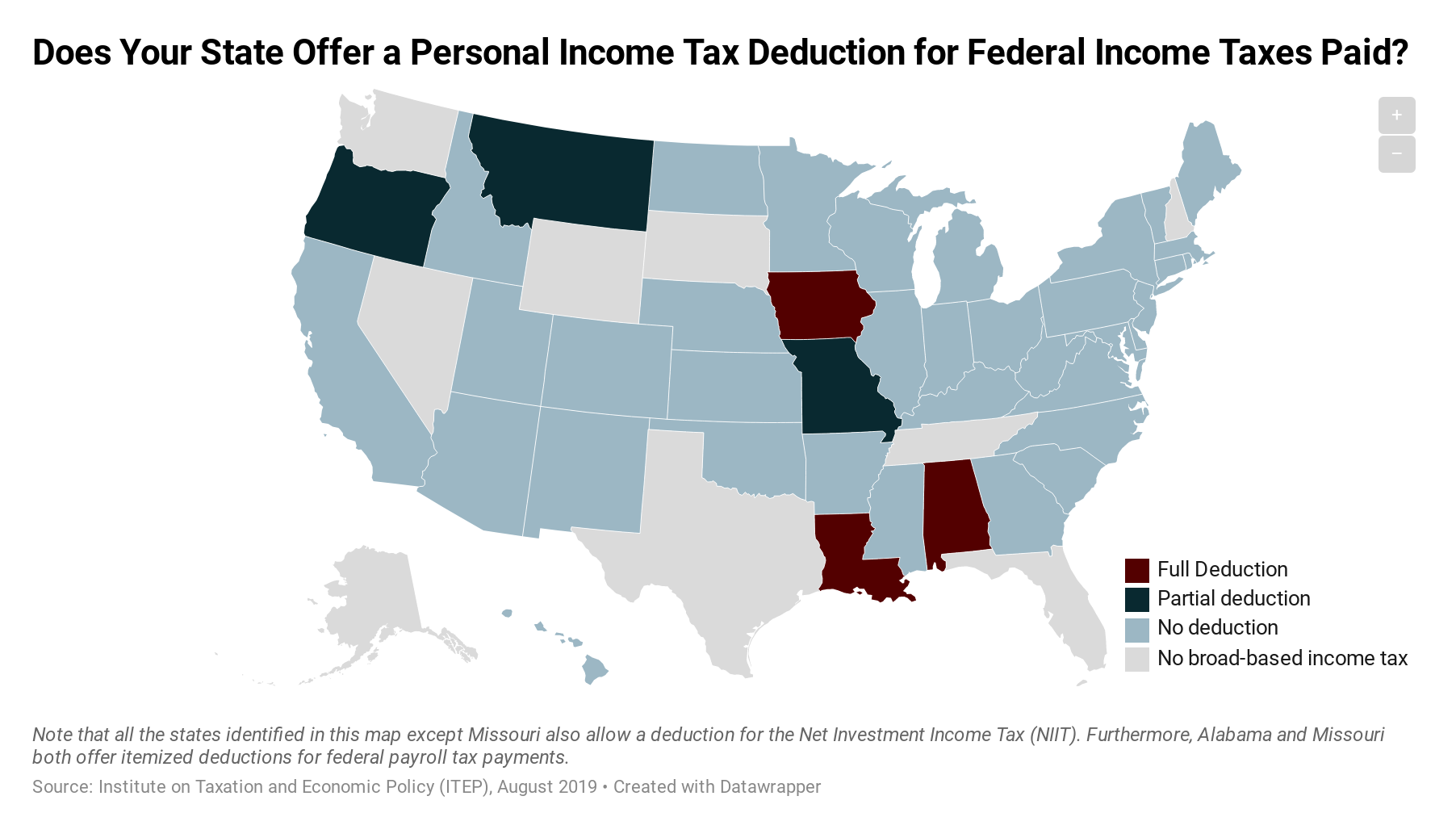

In Georgia however the deduction is. Deductions can reduce the amount of your income before you calculate the tax you owe. The contribution you will make will come straight out of your paycheck before its taxed and the money goes tax-free into the 401k or 403b.

How The Tcja Tax Law Affects Your Personal Finances

2019 Budget Income Tax Cuts From 1 July 2018 Moschners Chartered Accountants

The 4 Tax Strategies For High Income Earners You Should Bookmark

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

How To Reduce Taxable Income For High Earners Australia Ictsd Org

How The Tcja Tax Law Affects Your Personal Finances

5 Outstanding Tax Strategies For High Income Earners

Summary Of The Latest Federal Income Tax Data 2022 Update

Tax Strategies For High Income Earners Wiser Wealth Management

4 Tax Breaks For High Income Households The Motley Fool

Tax Agent Fees A Commonly Overlooked Tax Deduction

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

How Do Marginal Income Tax Rates Work And What If We Increased Them